24/7 AOG Critical Response

Hotline![]() UK +44 1403 798888US +1 877 780 2008

UK +44 1403 798888US +1 877 780 2008

Our award winning global AOG service is manned 24 hours a day, 365 days a year.

Please call +44 1403 798888 or email aog@ajw-group.com.

18 Dec 2023

As the holiday season kicks off and operators face the inevitability of grounded aircraft, OEMs and MROs deal with the plethora of challenges facing the industry. 2024 is rapidly approaching and we ask the question - what is in store for engine leasing in the coming years?

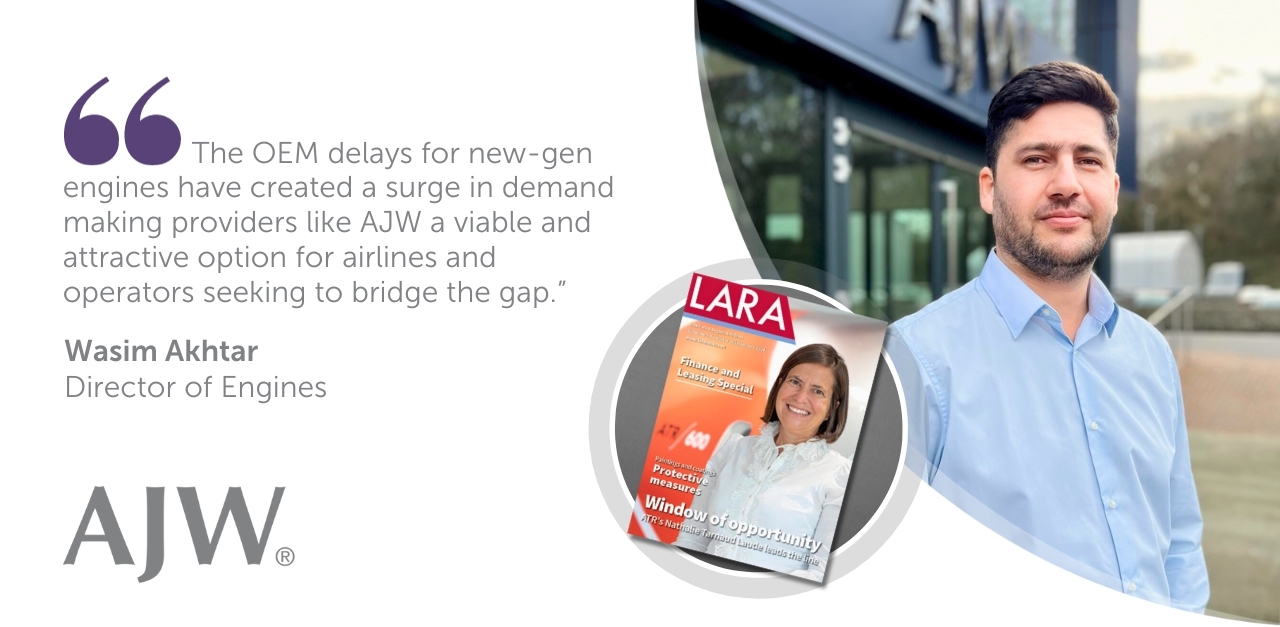

LARA magazine speaks to AJW Director of Engines, Wasim Akhtar, about the Group’s engine portfolio, the impact of the struggling supply chain on engine leasing and sales, the nature of leasing contracts, and the outlook for 2024.

The challenges in the aviation industry present positive prospects for engine lessors with older-generation engines in their inventory. However, the finite supply of older engines like CFM56 and V2500, coupled with increasing maintenance demands, intensifies supply chain difficulties.

Despite the current engine issues being a short-term setback, lessors must also focus on expanding their portfolios with new-generation engines like LEAP and GTF, considering the transient nature of the challenges. Looking ahead to 2024, lessors face a complex landscape in the world of engine finance.

Akhtar highlights that both new-generation and older engine models face increased demand. Despite AJW’s portfolio including older engine types like CMF56, V2500, PW4000, and RB211, he notes a substantial resurgence in demand for these "bread and butter" engines, particularly for narrowbody aircraft such as the Boeing 737NG and Airbus A320. This trend plays a crucial role in the Group’s business operations.

There is a noticeable trend among operators to extend leases on aging engine types like CFM56 and V2500, he says. This inclination is expected to continue for at least another 24 months as the aviation industry undergoes a transitional phase. Akhtar emphasises that AJW's capability to facilitate lease extensions has been a crucial solution for operators seeking to maintain operational continuity for their fleets. He states,

“AJW's expertise in providing engine leasing services positions the company as a reliable partner in helping operators maximise the lifecycle of their engines despite the ongoing logistical challenges.“

The operational life of engines is being maximised, however, the industry is trending away from short-term leases and towards longer ones due to heavy market demand. Akhtar states,

“Low fare and regional operators are leaning towards longer-term engine leases; they provide a more extended duration. “The recovery in travel demand necessitates a reliable and consistent engine supply to meet operational requirements, favouring longer-term agreements that provide a more stable and predictable engine fleet.”

He continues, “The OEM delays for new-gen engines have created a surge in demand making providers like AJW a viable and attractive option for airlines and operators seeking to bridge the gap.”

For the AJW Director of Engines, the outlook for 2024 is uncertain. While the market is experiencing rapid growth, driven by airlines opting for leasing to avoid high upfront costs, challenges remain in terms of engine availability and values. Akhtar predicts rates declining to pre-pandemic levels due to high demand for engines. However, he expresses confidence in sustained market demand for narrow-body engines, reaffirming the company's commitment to maintaining and potentially expanding its presence in this sector of the aviation industry.